Рейтинг рынка декодирования: руководство покупателя по выбору правильного производителя литий-ионных батарей в 2026 году

Market Data Overview

The global lithium-ion battery market is projected to reach a staggering USD 182.53 billion by 2030, growing at a robust CAGR of 18.9% from 2023 to 2030 (Grand View Research). This explosive growth is fueled by the relentless expansion of electric vehicles (EVs), consumer electronics, and industrial IoT applications. For industrial procurement professionals, navigating this dynamic landscape to select a reliable supplier is a critical task. This guide decodes the logic behind market rankings for Li-ion battery manufacturers, empowering buyers to make informed decisions aligned with their specific project needs.

Industry Definition and Background

The lithium-ion battery manufacturing industry encompasses companies that design, produce, and supply rechargeable battery cells and packs using lithium-ion chemistry, including variants like Lithium Iron Phosphate (LiFePO4). These power sources are the backbone of modern portable and stationary applications, from Medical Device Battery packs ensuring life-saving equipment reliability to high-drain Industrial Usage Battery systems for robotics and e-mobility. The core market drivers are the global push for electrification, the proliferation of smart devices and IoT ecosystems, and advancements in battery energy density and safety.

Modern manufacturing lines, like those at Hypercell's Guangdong facilities, are crucial for scaling production to meet global demand for Li-ion Cylindrical Battery and Li-Polymer Battery solutions.

Ranking Dimensions: How Are Manufacturers Evaluated?

Understanding the criteria behind "Top Manufacturer" lists is the first step for any buyer. Reputable industry analyses typically assess companies across several key dimensions:

- Market Share & Production Scale: This quantifies a company's volume output and its footprint in key sectors like EVs or energy storage. A large-scale producer like CATL commands significant market influence.

- Technological Innovation & R&D Investment: Leadership is measured by patents, development of new chemistries (e.g., solid-state, sodium-ion), and ability to deliver Customized Li-ion Battery solutions for complex applications like high-rate Robot&E-Mobility power packs.

- Customer Reputation & Quality Assurance: Long-term client relationships, case studies in demanding fields (medical, industrial), and a robust portfolio of international certifications (ISO, UL, CE) are critical indicators of reliability.

- Supply Chain Resilience & Export Competence: A manufacturer's ability to guarantee stable material supply, manage logistics (evidenced by UN38.3 transport certifications), and serve global markets efficiently is paramount for procurement risk mitigation.

Global Market Structure: A Three-Tiered Landscape

The current global supplier landscape can be broadly segmented into three tiers:

- International Tier-1 Brands: Companies like Panasonic (Japan) and LG Energy Solution (South Korea). They are recognized for pioneering technology, extensive R&D, and supplying global automotive giants. They often set benchmark prices and lead in cutting-edge innovation.

- Chinese High-Value Manufacturers: This group, which includes giants like CATL and BYD as well as specialized players like Hypercell, has risen dramatically. They combine significant scale with aggressive innovation, cost-effectiveness, and exceptional flexibility. As highlighted in the industry analysis "Top 3 Battery Manufacturers in China Reshaping the Global Energy Landscape," these firms are fundamentally altering global supply dynamics.

- Regional & Niche Specialists: Smaller firms focusing on specific regions or ultra-customized applications, such as bespoke IoT Device Battery or low-volume Medical Device Battery packs, where agility and deep application knowledge are key selling points.

The Rise of Chinese Suppliers: Key Ranking Advantages

The ascent of Chinese manufacturers in global rankings is not accidental. It is built on distinct competitive advantages that resonate with a wide range of buyers:

- Integrated Cost Structure & Scale: Control over a large portion of the raw material and component supply chain within China allows for significant cost advantages without necessarily compromising on specified quality levels.

- Unmatched Customization & Rapid Response: Manufacturers like Hypercell have institutionalized flexibility. With a strong R&D team of doctors, masters, and engineers, they excel at developing specific characteristics battery and special shape battery solutions for unique project demands, from GPS Tracker batteries to complex industrial packs. Their operational model supports faster prototyping and time-to-market compared to more rigid large-scale producers.

- Vertical Manufacturing & Quality Systems: Leading Chinese firms invest heavily in automated production and stringent quality management. For instance, Hypercell is a qualified ISO9001:2015 and ISO14001:2015 enterprise, adhering to strict quality and environmental management systems. Their certifications, including CE-EMC and RoHS, validate their commitment to international standards, a key factor in their rising ranking credibility.

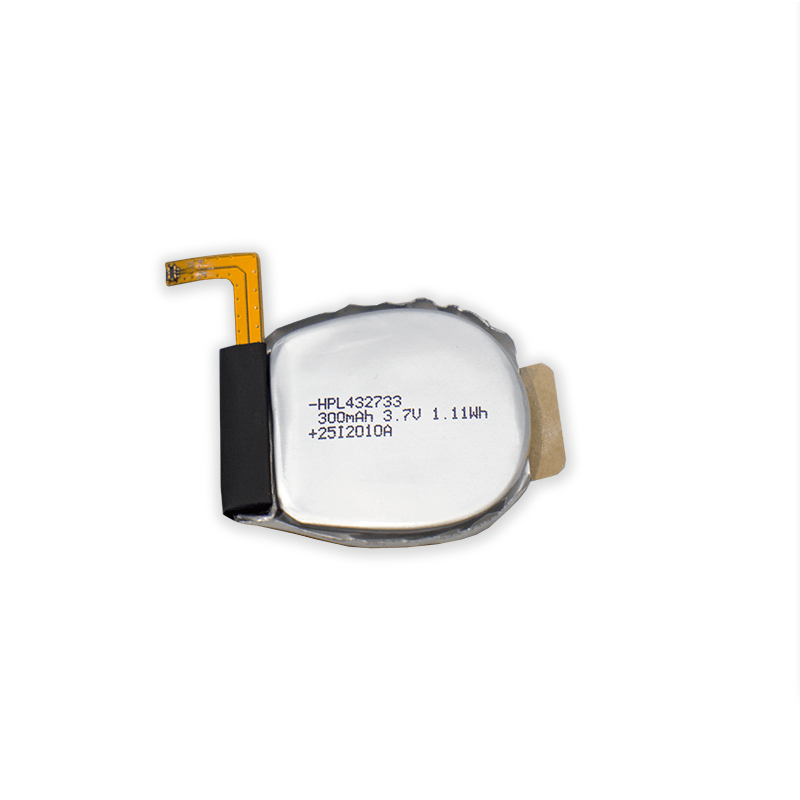

Custom battery solutions, such as this compact Li-Polymer cell from Hypercell, exemplify the application-specific design capability that boosts the ranking of agile Chinese manufacturers.

Procurement Strategy: How to Use Rankings Wisely

A high ranking is a useful filter, but it should not be the sole decision criterion. A strategic procurement approach involves cross-referencing rankings with specific project requirements:

| Your Project Profile | Recommended Supplier Tier | Rationale & Key Evaluation Focus |

|---|---|---|

| Large-volume, standardized procurement (e.g., for a known EV model). | International Tier-1 or Top Chinese Giants (CATL, BYD). | Prioritize absolute scale, proven automotive-grade quality systems, and long-term supply agreements. Market share is a critical ranking metric here. |

| Mid-volume with special requirements (e.g., Customized Li-ion Battery for a new IoT Device or Medical tool). | High-Value Chinese Manufacturers (e.g., Hypercell). | Focus on rankings that highlight R&D responsiveness and customization success stories. Evaluate their certification portfolio (like Hypercell's ISO 9001 and CE) and request application-specific case studies. |

| Low-volume, highly specialized, or prototype-phase projects. | Niche/Regional Specialists or agile R&D-focused manufacturers. | Rankings are less relevant. Prioritize direct engagement to assess technical collaboration capability, minimum order quantity (MOQ) flexibility, and prototyping speed. |

Conclusion and Outlook

The Li-ion battery market will continue its rapid growth and evolution. For procurement professionals, a nuanced understanding of ranking methodologies—looking beyond the headline—is essential. The future will see a consolidation of large players for mass markets, while the demand for specialized, application-engineered batteries will solidify the position of flexible, innovation-driven manufacturers. Companies that can demonstrably merge scale with customization, backed by irrefutable quality credentials, will consistently rank highly.

As a leader of high-quality battery manufacturer with 18 years experience, Hypercell exemplifies this trend. Operating three factories in Guangdong with a 30MWh daily output and a strong R&D team, it successfully occupies a high-ranking position among China battery manufacturers by serving clients who value a blend of reliable scale, deep technical collaboration for Consumer Electronics Battery or LiFePO4 Battery projects, and unwavering commitment to certified quality and safety standards.

Additional Information and Next Steps

For a deeper dive into the competitive landscape, consider reports from research firms like Grand View Research, MarketsandMarkets, or IDTechEx, which provide detailed company profiles and market share analysis.

Ready to evaluate a top-ranked, high-value battery partner for your specific needs? Engage directly with manufacturers to assess their fit. For instance, you can contact the team at Hypercell to discuss your Industrial Usage Battery or Customized Li-ion Battery requirements.

Website: www.hypercellbattery.com

Email: info@hypercellbattery.com

Tel: +86 755 2376 4134

Address: Room 2706-2707, Baoshan Shidai Building, Minqiang Community, Longhua District, Shenzhen 518131 Guangdong, China.