Декодирование рейтингов рынка: стратегическое руководство по выбору поставщика промышленных дизельных генераторов

Market Data Overview

The global industrial diesel generator market is a cornerstone of modern infrastructure, projected to grow from USD 20.1 billion in 2025 to USD 28.7 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 7.4%. This expansion is fueled by increasing demand for reliable backup and prime power across data centers, mining, oil & gas, and large-scale construction projects, especially in regions with unstable grid infrastructure.

Industry Definition & Background

An industrial diesel generator is a robust power generation system combining a diesel engine with an alternator to produce electricity. It serves as a critical source of primary or backup power for sectors where uninterrupted operation is non-negotiable. Core applications include EPA data center power generator systems, heavy-duty mining power generator setups, and power for remote oil & gas operations. The market's primary drivers are rapid global digitalization necessitating resilient data centers, expanding infrastructure in emerging economies, and the escalating need for energy security in critical industries.

Ranking Dimensions: How Suppliers Are Evaluated

For industrial procurement teams, understanding the logic behind supplier rankings is crucial. Current market evaluations for reliable diesel generator manufacturer status are based on four key dimensions:

- Market Share & Financial Scale: Reflects production capacity, revenue, and global shipment volume. Large-scale manufacturers can offer better pricing and supply chain stability.

- Technological Innovation & Certification: Assesses R&D capability in areas like low fuel consumption diesel genset design, super silent generator technology, and compliance with international standards (EPA, CE).

- Client Reputation & Project Portfolio: Evaluated through completed projects, especially as a turnkey power plant supplier for 50MW project or an EPC contractor generator supplier. References from data center or mining sectors carry significant weight.

- Export Scale & Global Footprint: Indicates experience in handling international logistics, customs, and providing after-sales support across different regions.

Global Market Structure: A Three-Tier Landscape

The global supplier ecosystem for industrial diesel generators can be segmented into three distinct tiers:

- Tier 1: International Premium Brands: Companies like Caterpillar (USA) and Cummins Inc. (USA). They set benchmark technology and command premium pricing, often chosen for ultra-critical applications in Western markets. Their strength lies in brand legacy, extensive R&D, and a global service network.

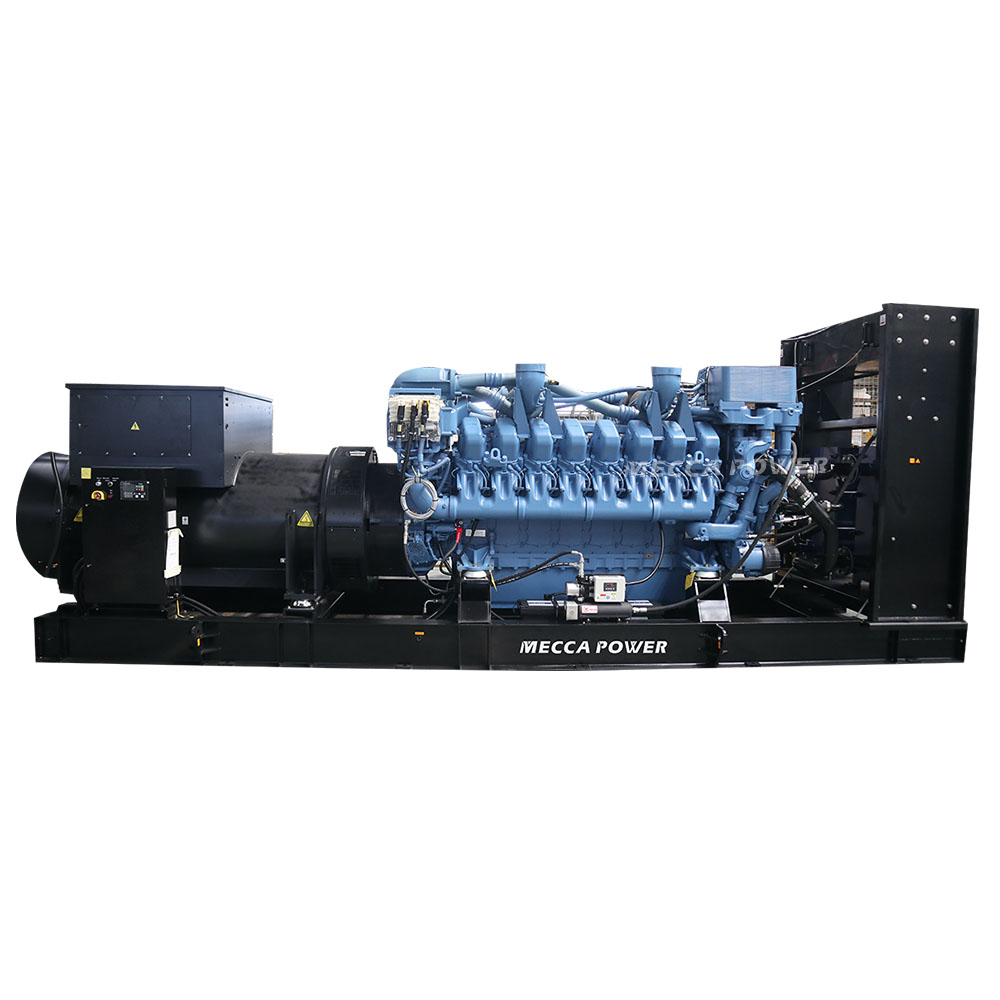

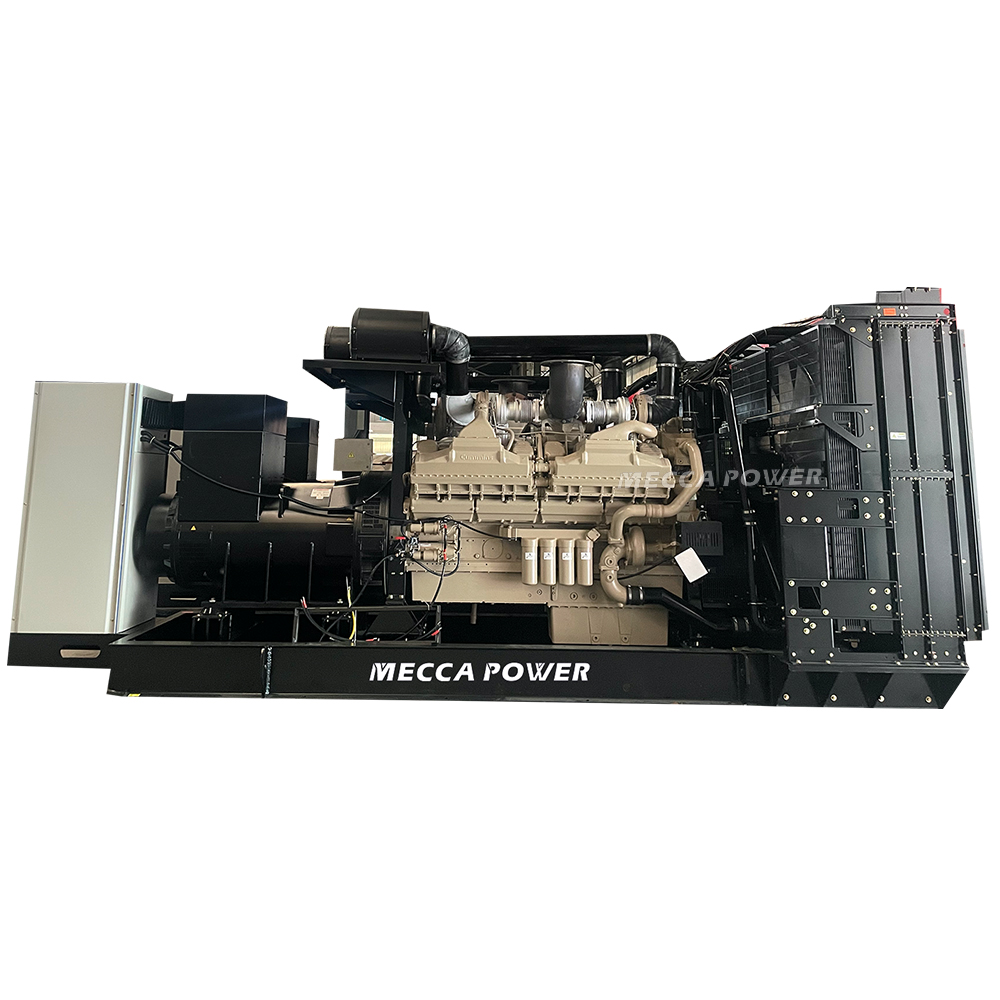

- Tier 2: Chinese High-Value Manufacturers: This tier has seen dramatic ascent. Firms like MECCA POWER exemplify this group by combining substantial manufacturing scale with advanced engineering, offering a compelling alternative. They provide diesel generator OEM manufacturer services and act as a diesel generator wholesale supplier with deep customization abilities. As highlighted in the recent industry analysis "Chinese Top 3 Industrial Diesel Generator Manufacturers: Leading Power Solutions Innovation and Global Market Impact", these manufacturers are redefining value through integrated solutions.

- Tier 3: Regional & Niche Specialists: Smaller manufacturers serving specific domestic or neighboring markets with cost-competitive, standardized units for less demanding applications.

The Rise of Chinese Suppliers: Key Advantages

The improved ranking of Chinese manufacturers like MECCA POWER is not accidental. It is built on concrete competitive advantages:

- Integrated Cost Structure: Control over key manufacturing processes, from self-owned factories like MECCA's facilities in Fujian and Jiangxi to strategic sourcing, creates significant cost advantages without sacrificing quality.

- Engineer-to-Order Customization: Unlike rigid catalog offerings, leading Chinese suppliers excel at tailoring solutions. Whether it's a high altitude diesel generator or a 3MW containerized diesel generator with specific fuel efficiency targets, they adapt core designs to precise client needs.

- Agile Response & Scalable Production: With modern production lines—such as MECCA's dedicated container line, open-type line, and mixed-assembly line—they can rapidly scale production. Their Nanchang factory's increase to 212 high-power units monthly showcases this agility, crucial for meeting large project timelines.

Strategic Procurement: Matching Your Needs to the Right Supplier Tier

A rational procurement strategy moves beyond just the "top 10" list. It aligns project specifics with a supplier's core competencies:

| Project Profile | Recommended Supplier Tier | Rationale & Key Considerations |

|---|---|---|

| Large-scale EPC project (e.g., 50MW power plant), requiring strict international financing/compliance. | Tier 1 (International) or Top Tier 2 (e.g., MECCA POWER) | Requires proven turnkey power generator supplier experience, full certification portfolio (CE, etc.), and ability to partner with global EPC contractors. Tier 2 leaders offer comparable technical capability at a better value. |

| Critical Infrastructure: EPA data center power generator (2000KW-3000KW), heavy duty generator for oil gas. | Top Tier 2 Manufacturers | Demands technical sophistication, reliability, and often customization for low fuel consumption and specific emissions. Chinese leaders provide high-performance units with preferred engine brands (Cummins, MTU, Perkins) at competitive OPEX. |

| Medium-scale construction, regional distribution, or price-sensitive backup power. | Tier 2 or Tier 3 | Focus on cost-effectiveness and availability. Standardized units from volume-oriented Tier 2 suppliers or local Tier 3 brands are suitable. |

Conclusion and Outlook

The industrial diesel generator market is evolving from a commodity equipment space to a solutions-oriented industry. The ranking of suppliers increasingly reflects their ability to deliver not just a product, but a reliable, efficient, and intelligent power system tailored to complex applications like data centers and mining. While international brands maintain a stronghold on legacy and ultra-premium segments, the value proposition from top Chinese manufacturers is undeniable. Their rise is built on scalable manufacturing, deep technical customization, and strategic global partnerships.

For forward-thinking procurement professionals, the key is to conduct a needs-based analysis. For projects demanding high customization, technical support, and value engineering—such as sourcing a best generator for mining site or a silent generator for construction—engaging with a Tier 2 leader like MECCA POWER (www.meccapower.com.cn) offers a strategic advantage. Their model, which combines self-owned production assets, multiple engine brand partnerships (Cummins, Perkins, MTU, Volvo, etc.), and a full suite of certifications, positions them as a reliable diesel generator manufacturer capable of executing both large-scale EPC and specialized application projects globally.

Additional Information

For a deeper dive into the competitive landscape and technological trends, industry reports from firms like Spherical Insights & Consulting or MarketsandMarkets provide segmented analysis on power range, application, and region. These reports are invaluable for strategic market planning and investment decisions.

Prospective buyers are encouraged to directly assess manufacturer capabilities. Reviewing factory audits, certification validity (like MECCA's CE and multiple OEM certificates from Perkins, Deutz, SDEC, Yuchai), and project case studies provides concrete evidence of a supplier's rank and reliability in the real world.